Introduction:

In the rapidly evolving financial environment of today, credit risk holds immense importance for banks and digital marketing platforms. The occurrence of defaulted loans and the presence of high-risk customers can profoundly influence the financial well-being and profitability of these entities. To tackle this challenge, the implementation of sophisticated analytics techniques, including credit risk classification models, has become crucial for evaluating and managing credit risks effectively. This blog post aims to delve into the concept of credit risk classification models and their practical application within the realms of banking and digital marketing. By examining these models, we can gain valuable insights into the strategies employed for risk management in these domains.

I. Understanding Credit Risk Classification Models:

- Definition and Importance:

Credit risk classification models are predictive models that help in identifying and categorizing customers or borrowers based on their creditworthiness. These models leverage historical data, customer attributes, and financial indicators to estimate the likelihood of default or non-payment. By accurately evaluating credit risk, institutions can make informed decisions regarding loan approvals, credit limit determinations, customer segmentation, and targeted marketing campaigns.

- Role of Credit Risk Models:

Credit risk models play a crucial role in mitigating risks and optimizing resource allocation for both banks and digital marketing platforms. By evaluating credit risk accurately, these institutions can minimize losses, improve profitability, and enhance customer relationships. These models enable them to make data-driven decisions, identify potential defaults, tailor their offerings to different customer segments, and enhance fraud detection and prevention mechanisms.

Methodology:

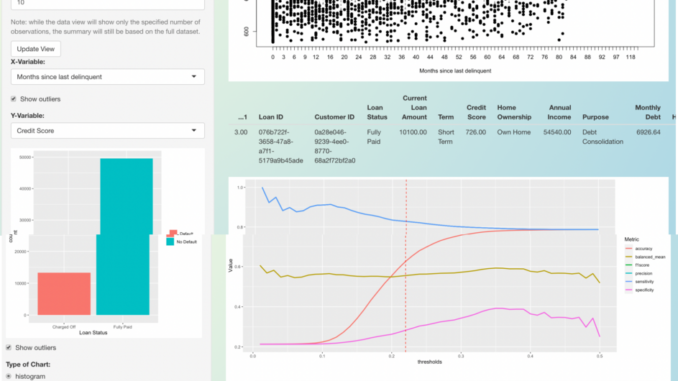

Our methodology involved employing the logistic regression model and conducting a series of tests to refine and optimize its accuracy and complexity. Through a process of backward selection, we systematically removed predictors that had minimal impact on the model’s outcome. This step allowed us to streamline the model by focusing only on the predictors that made the most significant contribution to predicting credit risk. By iteratively refining the model based on these tests, we were able to identify the optimal combination of predictors that yielded the highest accuracy while maintaining the simplest possible model. This approach ensured that our final model struck the right balance between predictive power and interpretability.

We developed a user-friendly browser-based interface using Shiny, specifically tailored for banks and digital marketers. This intuitive interface allows users to effortlessly visualize the predicted outcomes based on their input data. With the application’s current implementation, clients can conveniently input numerical values and immediately obtain the corresponding outputs, providing valuable insights into credit risk classification. Additionally, the interface offers the capability to visualize the relationships between the various predictors, enabling users to gain a deeper understanding of how different factors impact the predicted outcomes. This user interface serves as a powerful tool for decision-makers in the banking and digital marketing industries, empowering them with actionable insights and facilitating informed decision-making processes.

II. Building a Credit Risk Classification Model:

- Data Collection and Preparation:

a. Gathering Relevant Data:

Banks and digital marketing platforms need to collect comprehensive and accurate data on customer attributes, financial information, credit history, and transactional behavior. This data serves as the foundation for developing robust credit risk classification models.

The dataset used in this study is a synthetic bank dataset specifically generated for research purposes. The data was meticulously designed to emulate the characteristics of real loan data, ensuring its relevance and applicability in our analysis. The dataset comprises 77,823 loan records, each containing 20 columns of valuable information. By utilizing this comprehensive dataset, we were able to conduct a thorough analysis and develop an accurate credit risk classification model that can effectively predict loan outcomes. The carefully crafted nature of the dataset enhances the reliability and validity of our findings, making them highly relevant for decision-making in the banking and financial sectors.

b. Data Cleaning and Preprocessing:

Data cleaning and preprocessing involve handling missing values, removing outliers, transforming variables, and ensuring data quality and consistency. This step ensures that the data used for training the model is reliable and relevant.

- Feature Selection and Engineering:

a. Identifying Key Features:

Domain knowledge and statistical analysis are used to select the most relevant predictors that significantly impact credit risk. Factors such as income, employment history, credit utilization, payment history, and debt-to-income ratio are often considered important features.

b. Feature Engineering:

Feature engineering involves creating new variables or transforming existing ones to enhance the predictive power of the model. Techniques such as scaling, normalization, and creating interaction variables can help improve the model’s performance.

- Model Selection and Training:

a. Choosing an Appropriate Model:

Popular models for credit risk classification include logistic regression, decision trees, random forests, and support vector machines. Each model has its strengths and weaknesses, and the selection depends on the specific requirements and characteristics of the data.

b. Training and Validation:

During the modeling process, we divided the dataset into two main parts: the trainset and the testset. The trainset accounted for 35% of the data, while the testset comprised the remaining 65%. This division allowed us to train our credit risk classification model on a subset of the data and assess its performance on an independent set of observations.

- Model Evaluation and Performance Metrics:

In our credit risk classification model, we identified several significant predictors that played a crucial role in determining loan outcomes. These predictors included:

Credit Score: The credit score of an individual serves as a key indicator of their creditworthiness. A higher credit score suggests a lower risk of default, while a lower score indicates a higher risk.

Term: The term refers to the duration of the loan. It helps assess the borrower’s ability to repay the loan within the specified timeframe. Longer loan terms may increase the risk of default.

Annual Income: The annual income of the borrower provides insights into their financial stability and capacity to meet loan repayment obligations. Higher incomes generally indicate a lower risk of default.

Current Loan Amount: The current loan amount refers to the total amount borrowed by the individual. It helps determine the borrower’s debt burden and their ability to manage additional debt. Higher loan amounts may increase the risk of default.

Debt Ratio: The debt ratio measures the borrower’s level of indebtedness relative to their income. A higher debt ratio implies a greater risk of default, as the borrower may struggle to meet their financial obligations.

Monthly Debt: The monthly debt represents the borrower’s recurring debt payments. It helps assess their ability to handle additional loan repayments. Higher monthly debt may indicate a higher risk of default.

In our modeling process, we used the logistics regression model, a widely used statistical technique for predicting binary outcomes. The model’s performance was evaluated using the Akaike Information Criterion (AIC), which measures the quality and complexity of the model. A lower AIC value (in this case, 19767) indicates a better-fitting model with optimal predictive power.

By considering these significant predictors and utilizing the logistics regression model with an AIC of 19767, our credit risk classification model was able to effectively assess the likelihood of default and provide valuable insights for banks and digital marketers. These predictors can aid in making informed decisions regarding loan approvals, risk management strategies, and targeted marketing campaigns, ultimately improving the overall efficiency and effectiveness of credit risk assessment processes.

a. Confusion Matrix:

A confusion matrix provides insights into the model’s predictive accuracy, including true positives, true negatives, false positives, and false negatives. It serves as a foundation for calculating various performance metrics.

b. Accuracy, Precision, Recall, and F1-Score:

These metrics help evaluate the model’s overall performance, its ability to correctly identify defaults and non-defaults, and the trade-offs between precision and recall. They provide a comprehensive understanding of the model’s effectiveness in credit risk classification.

III. Application in Banking and Digital Marketing:

- Credit Risk Management in Banking:

a. Loan Approval and Risk Assessment:

Credit risk classification models assist banks in making informed decisions about loan approvals, setting appropriate interest rates, and determining credit limits based on customer creditworthiness. By analyzing customer data, including income, credit history, and financial indicators, these models provide insights into the probability of default. This enables banks to mitigate risks by identifying high-risk borrowers and adjusting lending terms accordingly. Additionally, credit risk models support the evaluation of collateral requirements and the development of risk-based pricing strategies, ensuring that loans are allocated to customers with a higher likelihood of repayment.

b. Customer Segmentation:

By categorizing customers based on credit risk, banks can tailor their product offerings and marketing strategies to different customer segments. Credit risk classification models allow banks to identify low-risk customers who may be eligible for preferential interest rates or targeted promotional offers. On the other hand, high-risk customers can be offered personalized credit counseling or alternative financial products to mitigate potential default risks. This segmentation approach helps optimize resource allocation, improve customer satisfaction, and minimize credit losses.

- Digital Marketing and Credit Risk:

a. Targeted Marketing Campaigns:

Credit risk classification models also find valuable applications in digital marketing. By utilizing customer data and credit risk assessment, digital marketing platforms can identify potential customers who are likely to be creditworthy. This enables more effective targeting of marketing campaigns and personalized offers, reducing the risk of defaults and improving the return on investment (ROI) of marketing efforts. By tailoring messages and promotions to specific customer segments based on their credit risk profile, digital marketing platforms can optimize customer acquisition and retention strategies.

b. Fraud Detection and Prevention:

Credit risk models, coupled with advanced analytics techniques, enhance fraud detection and prevention mechanisms in digital transactions. By analyzing customer behavior, transactional patterns, and credit risk indicators, these models can identify suspicious activities that may indicate fraudulent behavior. Real-time monitoring and analysis of customer transactions enable digital marketing platforms to detect and prevent fraudulent activities promptly, safeguarding both the institution and the customers.

IV. Challenges and Future Directions:

While credit risk classification models offer significant benefits to banks and digital marketing platforms, several challenges and future considerations should be acknowledged:

- Data Availability and Quality:

Access to comprehensive and high-quality data is crucial for building robust credit risk models. Banks and digital marketing platforms need to ensure data accuracy, consistency, and completeness. Collaboration with credit bureaus and implementing data governance frameworks can improve data availability and quality.

- Model Interpretability:

Interpreting credit risk models and understanding the factors influencing credit decisions are important for building trust and compliance. Efforts should be made to develop transparent and interpretable models that provide explanations for credit risk assessments.

- Incorporating Alternative Data:

Traditional credit risk models heavily rely on historical financial data, but the availability of alternative data sources (e.g., social media activity, digital footprints) presents an opportunity to enhance credit risk assessment. Integrating alternative data can provide additional insights and improve the accuracy of credit risk classification models.

- Embracing Machine Learning and Artificial Intelligence:

Advancements in machine learning and artificial intelligence present opportunities for developing more sophisticated credit risk models. Techniques such as deep learning, ensemble methods, and explainable AI can enhance predictive accuracy and provide more actionable insights.

R Shiny App

The Data is visualised in an R shiny app for good user interface. The app consist of

- Defining the UI: Create the user interface (UI) using the

fluidPage()function. Within the UI, you can use different input and output elements like sliders, select inputs, checkboxes, plot outputs, etc., to allow users to interact with the app and view the results. - Defining the server logic: Create the server function using the

server()function. This is where you define the reactive behavior of the app, such as reading data, performing calculations, and generating outputs based on user inputs. - Connecting UI and server: Use the

shinyApp()function to connect the UI and server functions together. - Runing the app: Use the

shinyApp()function to run the app and view it in your browser. You can run the app locally on your computer or deploy it to a web server for others to access.

Conclusion:

Credit risk classification models play a vital role in managing credit risk for both banks and digital marketing platforms. By leveraging historical data, customer attributes, and financial indicators, these models provide valuable insights into creditworthiness, enabling institutions to make informed decisions regarding loan approvals, customer segmentation, and targeted marketing campaigns. By incorporating these models into their operations, institutions can optimize resource allocation, minimize credit losses, enhance customer satisfaction, and improve fraud detection and prevention. As technology continues to evolve, credit risk classification models will undoubtedly play an even more significant role in mitigating risks and ensuring the financial stability and profitability of institutions in the future.

The post Credit Risk Classification Model for Bank and Digital Marketing first appeared on Data Science Blog.

Leave a Reply