Merkle’s quarterly performance report for Q1 2020 provides insight into an impacted landscape heavily influenced by Covid-19 (coronavirus) across paid search, organic search, Amazon ads, display, and social media.

“Google Spend Growth Drops 11 Points Between January and March.”

Despite a strong start in January spend, with the rapid acceleration in coronavirus developing complications for businesses, Paid Search saw heavy drop off by the end of the quarter.

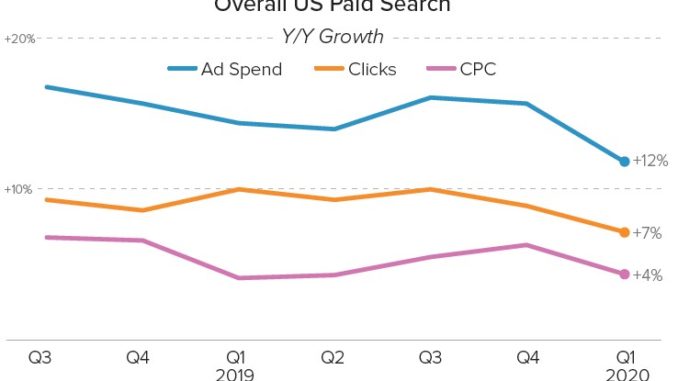

“Google search ad spend grew 11% Y/Y in Q1 2020, down from 16% growth in Q4 2019.”

With the 11-point difference in spend closing in March vs. the start of the quarter, it’s a clear indication of how much Covid-19 hurt media spend. Merkle indicated it is the weakest quarterly growth they have seen in eight years.

The travel industry and advertisers resulted in the largest decline overall in search spend, particularly on Google falling -21% Q1 2020 YoY vs. growth in Q4 2019 by 17%. In comparison, retailers maintained a somewhat flat trend and bounced back in March, with spikes in online shopping as retailers close or restrict access to physical locations. Ads highlighting in-store pick up and availability click-shares dropped, and local inventory ads click-share sharply dropped. Google Shopping Showcase ads are on the rise, as a result, and could be an opportunity for retailers to shift strategy.

It is also important to note that Amazon did pull back on its share of Google Text and Shopping ads, and eventually halted its Google Shopping program by the end of the quarter.

While Phone Search click-share had increase at 64% in Q1 2020 and 44% of total search ad spend, device traffic started a shift towards desktop by the end of March with stay-home mandates in place, and will most likely continue into Q2 2020.

Despite the coronavirus situational user behavior shift to more desktop (home) versus mobile, the search ad click-share for phones has gone up 3 points.

Organically, Google search visits saw a 13% decrease YoY Q1 2020, with a fall of 16% across mobile despite maintaining dominance in Search share. This could be attributed to the Covid-19 shift to stay-home lockdowns. Yahoo and Bing suffered the largest in search engine share of visits, while DuckDuckGo earned growth by 38% overall in Q1.

“Over the longer term, organic search visits have been under fire from the increased monetization of search results pages and the rise of zero-click searches.”

This highlights the importance of adding structured markups to sites, as they have the potential to gain rich results in SERP (search engine result pages). Essential retailers received the most growth during the downturn +53%.

“Amazon Ad Spend Levels Fall in Late March, But Should Rebound in Q2.”

“Sponsored Products spend rose 67% Y/Y in Q1 2020 as clicks grew 87% and CPCs fell 10%. With sales produced by Amazon Sponsored Products ads rising 70% Y/Y in Q1 2020.”

Fulfillment slows down in Q1 and will be potentially extended throughout remainder of Q2, with prioritization on essential products; Inventory shortages are being reported and should be noted.

Amazon conversion rates vs. Google, brands could potentially benefit from an uplift with a focus on Amazon Sponsored Products. Reported for Q1 2020, these ads are at 5x higher rate than average conversion versus Google’s Shopping Ads.

Covering display and social media, Facebook was the big winner here in terms of ad spend with a growth of 19% YoY in Q1 2020, excluding Instagram which remained relatively flat. YouTube experienced a decline late in Q1 as campaigns seemed to be impacted by coronavirus adjustments taking place. The platform dropped spend to around 20% of January’s daily average which is considerably a sharp change. As higher consumer digital connection remains ongoing into Q2, potentially low competitive share could be an opportunity for advertisers, who are able, to gain stronger share of voice.

Full report can be downloaded here.

Leave a Reply