- While Large Retailers Stayed the Course, Mid-Market Retailers Adjusted Their Use of Google Text Ads

- Google Text Ads Expanded Their Role on Thanksgiving, While Google Shopping Heated up on Sunday

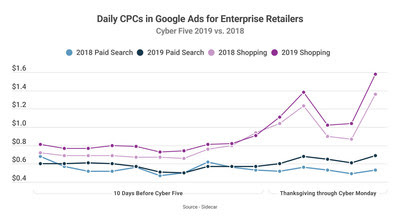

In its annual analysis of digital marketing trends during the holiday season’s hottest shopping days, , a provider of performance marketing solutions for retail, identified a shift in mid-market performance marketing strategy. This Cyber Five, Sidecar’s research found mid-market retailers maintained aggressive investments in Google Shopping, keeping their CPCs (cost per click) stable. At the same time, midsized retailers shaved Google text ad (paid search) costs by 9%, but still saw a 27% increase in clicks for the five-day period.

Large enterprise retailers competed aggressively in both Google paid search and Google Shopping during Cyber Five 2019. These retailers on average spent 24% more daily in Google Shopping YoY and 96% more daily in Google paid search YoY. This trend was attributable to their larger digital marketing budgets, coupled with their ability to maintain their return goals during the shopping period.

Mid-market retailers, who tend to have comparatively smaller performance marketing budgets, need to pick their battles. Ultimately, they chose to maintain aggressive investment in Google Shopping while pulling back on Google paid search ads. CPC trends followed suit, as depicted in the following charts.

Additional Highlights of Sidecar’s Cyber Five Findings

- On the whole across retail, the cost to compete in Google Shopping grew YoY during Cyber Five. For the five-day period, Google Shopping CPC averaged $1.12 in 2019, up from $0.98 in 2018.

- Also, across all retailers, Google paid search CPC averaged $0.62 during Cyber Five 2019, similar to $0.65 in 2018.

- Sunday saw the biggest YoY difference in Google Shopping CPC during Cyber Five. It went from $0.80 in 2018 to $0.96 in 2019, a 20% increase. Similarly, Sunday saw the highest YoY growth in Google Shopping average daily spend of the five days (+28%). This is an indication that retailers started taking greater advantage of the historically less competitive day of Sunday to bolster sales via Google Shopping, which wasn’t witnessed last year.

- By contrast, paid search played a larger role on Thanksgiving, with clicks to these ads increasing 70% YoY (the largest YoY click growth of the five days). Similarly, retailers grew paid search average daily spend the most on Thanksgiving of the five days (+32%).

“The tracking of retailers’ Google Ads during Cyber Five 2019 continues to demonstrate how the industry is adapting its competitive marketing approaches,” explained Mike Farrell, Senior Director of Market and Customer Intelligence for Sidecar. “In 2020, retailers will need to remain agile in how they engage shoppers throughout the purchase journey. It will be more critical than ever to know how consumers research, experience, and consume products, in order to invest in and optimize the right channels at the right time to meet their goals and drive growth.”

In its annual analysis, Sidecar examines Google Shopping and paid search during this Cyber Five shopping period (Thanksgiving through Cyber Monday). Pulling from a representative sample of U.S. retailers, Sidecar analyzed respective Google Ads accounts and compared performance to the same period in 2018.

Let’s block ads! (Why?)

Source link