Leading food companies have actually been willing to outsource their e-commerce organisations to Amazon, however the strategy brings long-term risks.So lots of food business have chosen to outsource their e-commerce operations to Amazon.Food leaders like Kraft Heinz, General Mills, and Mondelez do

operate websites for each of their brands, but they reroute visitors to Amazon to buy(if they even inform visitors how to acquire at all ). In other words, these huge conglomerates have actually been content to give Amazon final say over the method their items exist, offered, and shipped online.The strategy has pros and cons.It’s difficult without Amazon Setting up an e-commerce operation takes much more than just establishing a website.

These food companies would need to revamp their supply chains to satisfy single client orders rather of delivering to grocery stores. They ‘d need to design an online checkout process, partner with payment platforms, and potentially manage subscription options.They might have to employ more engineers.And historically, people don’t tend to shop for one item or brand name at a time in the food world. This poses a challenge for single-brand websites– however,

a parent business might likewise group all

its brands together.Big cash fast Meanwhile, Amazon guarantees solid and instant sales lifts.PepsiCo, for instance, exposed that

a 200-person e-commerce group, which establishes methods to sell through Amazon, Boxed, in the CornChips & Crisps category.What’s the risk?By outsourcing e-commerce operations to Amazon, companies risk losing control over their brand names and their customers.In the much shorter term, as we saw above with PepsiCo, brands can’t control how their search engine result appear Business can establish brand homepages on Amazon, which a minimum of support a few highlighted images

(like Pepsi’s or Oreo’s), or launch products in collaboration with Amazon(like Tyson’s Tastemakers). Amazon’s search bar doesn’t tend to highlight these, and they’re not as engaging as actual websites.They’re also dependent on Amazon for highlighting them in search results at all. Simply as Google and Facebook regularly tweak their search algorithms, so will Amazon.Intercepted at the point of sale As Amazon controls a growing number of points of sale– Amazon.com, Whole Foods stores, Echo devices– it acquires more leeway to intercept buyers and redirect them toward

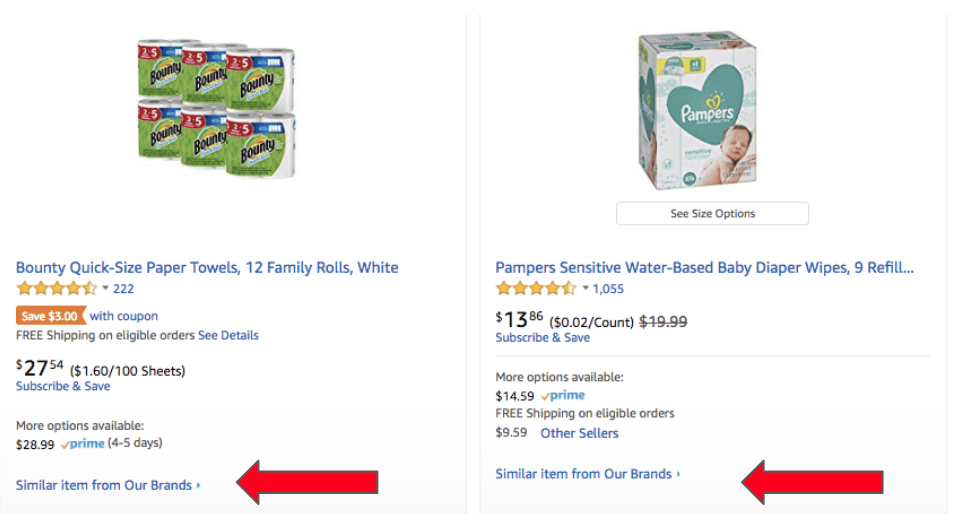

its own products.It’s currently started to boost its own competing private labels in search engine result. Picture credit: CNBC When Amazon promotes its own personal labels, it even more highlights the control

their own products’efficiency, Amazon’s able to track buyer habits across its website, at Whole Foods and its other brick-and-mortar stores, and, significantly, through its millions of Echo devices.The more brand names that focus the bulk of their e-commerce efforts on Amazon, the more information on those brands ‘shoppers Amazon gets.Amazon can likewise identify holes in the market where

brand-new personal label products may be most impactful.Will brand names feel comfy with Amazon having this information once Amazon broadens its$7.5 B private label business into their sectors?Or once it helps incubate new startup competitors?Alexa wants to pamper you And Amazon’s datasets will only grow.A patent last year noted information that Amazon’s thinking about collecting through smart video screens

, including people’s facial expressions and

moods, the brand names of items they have sitting around your home, and even pulse rates.Just the other day, Amazon was approved a patent on using the Echo to monitor people’s physical and emotions. If an Echo user’s voice sounds sniffly, Amazon might proactively recommend chicken soup.Which brands will Amazon proactively suggest?Big food business may be not able to wean themselves off Amazon, but they ought to think about investing more in their own customer relationships too.Another design Remarkably, Alibaba’s wishing to contend by posing itself as a pure platform, in contrast to Amazon’s double-dipping of service designs (platform+private label). Rather of using its information to launch its own private labels, Alibaba’s attempting to end up being an outsourced R&D center for brands.It partnered with Mars, using anonymized information on ~ 500M Alibaba buyers to establish a new chili-infused Snickers flavor.In the future, other market companies could pick between the Amazon model of turning information into products, and the Alibaba design of turning information into insights.For now, CPG leaders need to choose how much their devil’s bargain with Amazon deserves– and how much they must purchase their own data to compete.This material initially appeared in our CPG Insights newsletter. Sign up here to get a weekly rundown on the leading news & point of views in CPG.

Leave a Reply