The Year of the Rat (or mouse) is upon us, and for the world’s largest brands from beauty to activewear and fashion to jewelry, that means pulling out all the stops for Chinese New Year marketing campaigns. In addition to Double 11 and the Qixi Festival, Chinese New Year is one of the prime times for brands to roll out new digital initiatives to reach consumers in gift-giving mode. For brands launching Chinese New Year campaigns, it’s important to have a comprehensive cross-platform strategy that takes into account the relevant types of content and demographics on each platform, as well as ensure that the holiday campaign avoids cultural missteps that have resulted in negative online comments in recent years. This year, that probably also means taking into account the anxiety and suspended travel caused by the coronavirus outbreak. We rounded up the trends we’ve been seeing this year regarding what brands are up to online in China.

The Mickey Mouse Club

One of the world’s most famous mice, Disney’s Mickey has been embraced by global brands including Adidas, SK-II, and Gucci for Chinese New Year with extensive digital campaigns. SK-II’s special-edition Mickey essence bottle is being heavily promoted on Weibo via sponsored posts, a sponsored search brand zone and links to the brand’s Tmall shop. Gucci is selling its Mickey Mouse-themed collection on its mobile app as well as a WeChat Mini Program, which both feature Chinese New Year content promoting the collection, including a selfie camera allowing the user to add Mickey and Minnie ears. Selling collections on WeChat is no longer uncommon for luxury brands, as Gartner’s Digital IQ Index: Luxury China showed that 60% of tracked fashion brands offered WeChat commerce as of 2019.

Mickey isn’t the only famous cartoon mouse to be embraced by brands this Chinese New Year: Jerry of Tom & Jerry is the star of Kate Spade’s Chinese New Year collection that’s available on the brand’s new Tmall shop. And then there is Moschino, which decided to go a more subversive route and launch an edgy “Mickey Rat” collection that shows the not-so-cute side of the street-dwelling rodent.

Luxury Launches

Luxury brands often use Chinese holidays for new e-commerce platform launches and this Chinese New Year season saw Cartier and Kenzo open official flagships on Alibaba’s Tmall. Both have joined Tmall’s exclusive Luxury Pavilion section, and are selling special-edition Chinese New Year collections with holiday campaigns. Cartier, for example, is offering the first 288 buyers special services including custom jewelry box engraving and personal deliveries with flowers by Cartier’s signature bellboys. Gartner data shows that the number of luxury brands on Tmall continues to rise, with 51% of fashion brands selling on the platform as of September 2019 and 41% of watch and jewelry brands as of April 2019.

Let The Mobile Games Begin

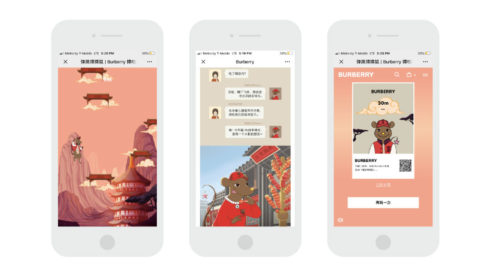

After luxury brands’ initiatives to woo Gen Z through mobile games were highlighted in Gartner’s Luxury China: Millennials and Gen Z report, Burberry has released a new game for Chinese New Year in the style of its earlier Doodle Jump-esque B Bounce game. The new iteration, Ratberry, is available on WeChat in China and uses a cartoon rat to promote the brand’s Chinese New Year collection available for sale online. The brand has also created a set of WeChat stickers to reach younger consumers as well as Douyin (which you may know by its global counterpart TikTok) videos featuring celebrity brand ambassadors with the cartoon rat.

A Family Affair

Brands are producing sentimental family-focused campaigns to tug at users’ heartstrings and inspire social sharing. Nike, for example, earned over 65,000 interactions on Weibo with a lighthearted and heartwarming video ad about the ritual of receiving red envelopes from grandparents on Chinese New Year. This engagement rate is especially high for a brand post not featuring a celebrity, as Gartner L2’s 2019 Activewear: China Insight Report found that 93% of activewear brands’ Weibo engagement was celebrity-driven. Other brands with family-focused campaign videos include Apple and Prada, while Gucci also got in on the action by sending top Chinese fashion influencers Mr. Bags, Becky Li and Fil Xiaobai to Disneyland with their friends and family, all clad head to toe in Gucci.

Palace Intrigue

The popularity of Chinese imperial aesthetics, a highlighted in Gartner’s Digital IQ Index: Beauty China 2019, remains strong this Chinese New Year as brands including MAC Cosmetics, Swarovski and Dove are partnering officially with China’s Palace Museum for special-edition products. MAC’s collaboration collection features lipsticks and color compacts with photogenic imperial designs perfect for sharing on social media, especially social shopping app RED. The brand launched a UGC campaign on RED to promote the collection, earning over 2.9 million interactions on the official campaign hashtag as a result. Swarovski is also promoting its Palace Museum collaboration on RED that earned 3.7 million interactions on the campaign hashtag, and links directly to product listings in the official Swarovski RED store.